|

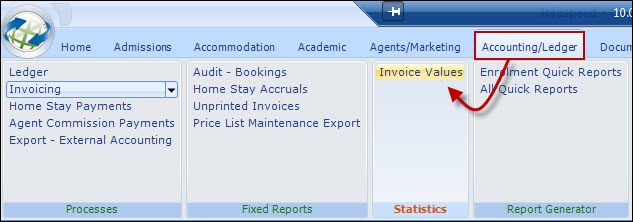

Invoice Values

|

|

Invoice Values

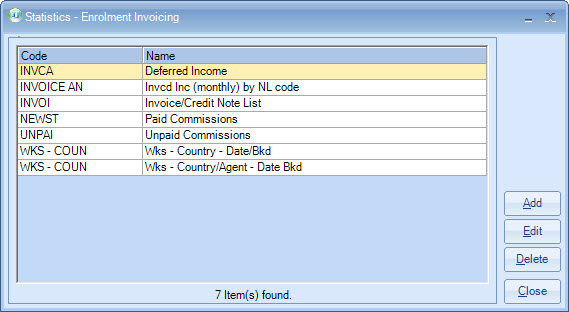

All statistics reports work in a similar

way.

To delete a

selection, highlight the value required and click the "Remove" button.

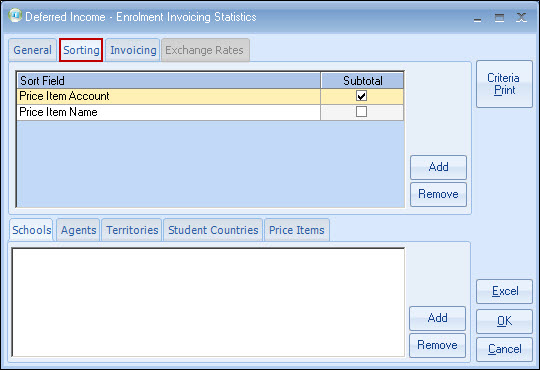

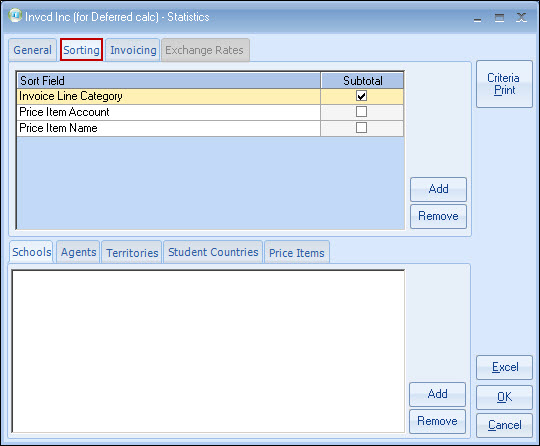

Sorting Options

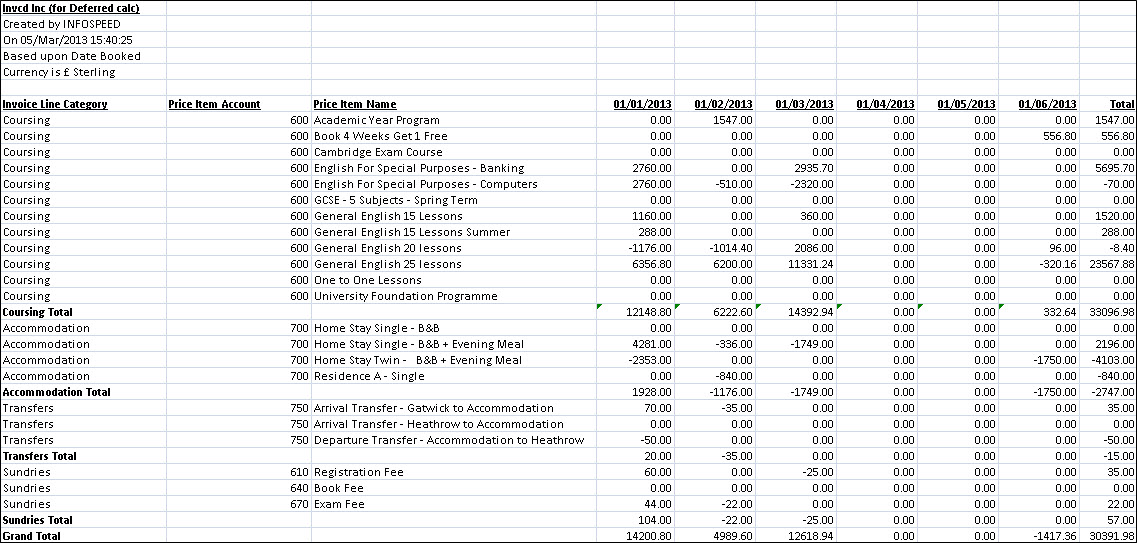

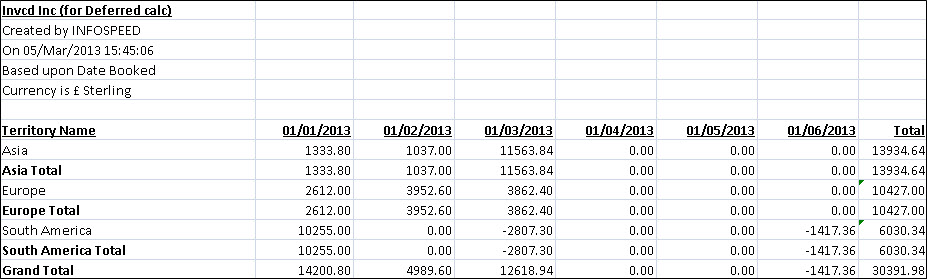

A typical use of "invoicing" statistics is to establish

the "deferred" sales at the end of an accounting period.

Deferred Sales/Forward

Income This clearly overstates the income in January and in

order to more accurately reflect the true sales for the month, it would be necessary to defer 11 months of the

income (£11,000) to future accounting periods. As £12,000 will have been credited to sales from the

posting of the invoice, the deferred value of £11,000 is correctly shown in the

column of 01/02/13. If forward bookings go into 2014, then this value will need

adding to 2013. DO NOT BE TEMPTED TO USE THE £1000 AS SALES FOR

THE MONTH! HOW? Before running the

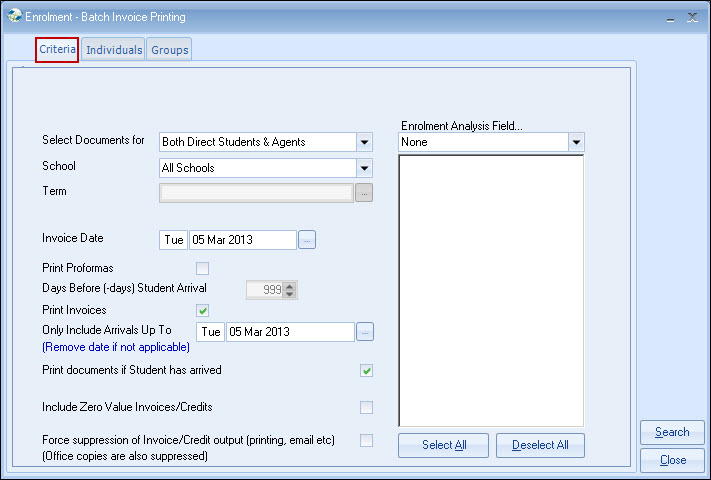

Deferred Income report, ensure all proformas for arrivals up to the period end

date have been converted to invoices.

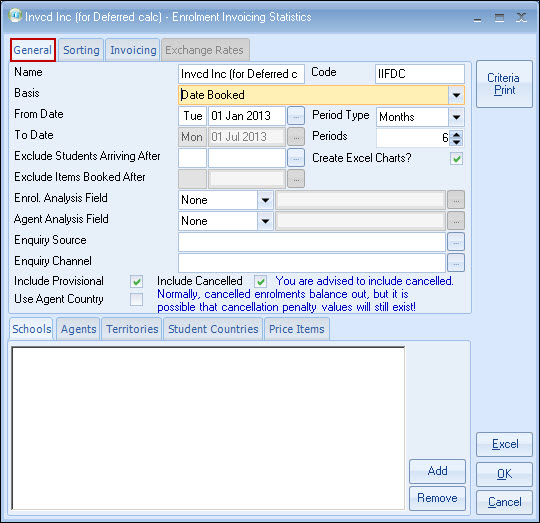

Statistics

Name

- As appropriate Sorting The above example shows 'Invoice Line Category'

(Tuition/Accommodation etc) and Nominal and the Price Item Name

(Course).

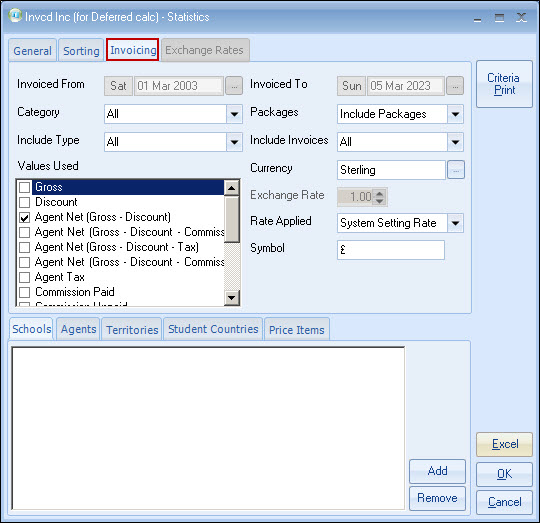

Invoice Date Range

Category If sales need to be "Grossed Up", then a separate report

(just for the single period) should be created using "Discount". Journals can be created in total or by element, as

required. Examples of other reports

General Information on statistical values:

Other values:

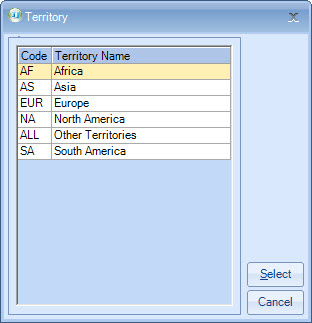

To include a selection, click on the tab for the category

required and click the "Add" button.

A selection form

will allow you to choose the value required, eg. for territories.

These will determine the sequence of records on the

report.

For each sort field added, sub totals can be

produced.

General

income from

invoices/credit is normally credited to the P&L account in the month the

invoice is produced, meaning an invoice dates 01/01/13 for £12,000 on a course

from 01/01/13 to 31/12/13 will initially show as £12,000 income in January

2013.

This is achieved by running a Statistics

(Invoicing) report to calculate the amount of deferred income.

Although it is tempting to get

Class to just show (invoiced) income on a month by month basis by spreading net

income over the duration of the course and using this as the basis for the

accounts, it is not the most accurate and best way to achieve correct figures.

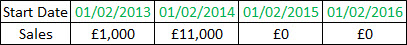

The best way to produce the

required figures is to create a statistics report that shows annual totals based

on the start date of the current accounting period, eg. if account are being

produced for the month of January 2013, then the report should start with

01/02/13 for say 4 years. This will show income for the example above as follows:

For the next accounting period, simply

move the date to 01/03/13.

Although in many cases this may be

the correct value, it will not accurately reflect all retrospective changes to

bookings (a frequent occurrence in language schools). It is also easier to prove

the forward sales figure by producing an audit list

of all the forward bookings (by name, invoice number etc).

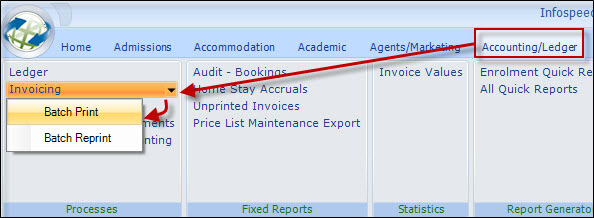

This is done by

running the Batch Invoice process, and dating the invoices as at the period end

date (as below).

Go into Reports > Reporting Module > Invoicing

Statistics.

Click on Add.

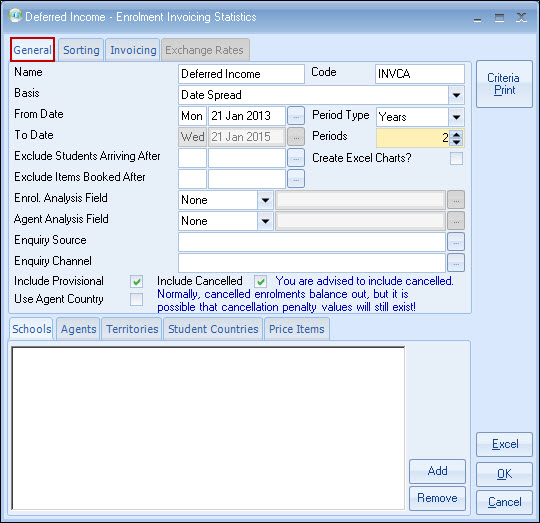

Basis - Use Date Spread (will

spread values over their duration)

Period Type - Years

From Date

-

The start of the current accounting period

Include Cancelled -

Yes, this allows for cancellation feeds to be included, if charged

At year ends, the student ID/name or invoice number may be

added to provide a much more detailed report for audit purposes.

Leave the start date unchanged, but set the end date to

the period eg. 31 January

2013.

This will ensure

invoices/credits raised after 31/01/13 are not included in the calculation.

Each category (Tuition/Accommodation/Transfers/Sundry)

can be run separately, but by including the invoice line category in "Sorting",

one report will suffice for all categories.

Packages - Include

Include Type - All

Include Invoices - Only select

invoiced. Proformas should not be included, although if invoicing had not been

run for week, a separate run for proformas would have provided figures for

"Sales not yet invoiced".

Value

Used - Agent Net (Gross-Discount). This is the amount transferred to debtors

and should be used for deferred sales.

A journal can then be created - Credit Sales, Debit, Discounts/Commissions.

In the above example, all income

from column 01/01/13

onwards is forward income ie. deferred income as at 31/12/12.

Country by Territory Totals (with Sub-Totals by

Territory)

The key values Class will only

accurately report on is:

Student Counts and

Enrolment Counts

These variables can be

misleading and confusing depending on how Class is operated.

Results can vary depending on time ranges, selection

criteria, and the impact of cancellations.

For this

reason, these 2 values are not recommended for statistical reporting.

Student Count

We acknowledge that there is a general interest in

"how many students" (defined as the number of unique student ID's in the period

being reported on).

The only place where student counts

should be used is the "Agent Stats" tab and the "All School Stats".

Enrolment Counts

If required, can be obtained from the "Statistics

Generator" (Enrolment Bookings).

Other place where "counts", "numbers" etc are indicated are

purely computer counts and may not necessarily reconcile with any other

figures.